Jarsy Research

Oct 9, 2024

This article analyzes the Financial Innovation and Technology for the 21st Century Act (FIT21) and its potential impact on tokenized assets, exploring regulatory changes, exemptions, and challenges in the evolving digital asset landscape.

Key Takeaways:

FIT21 aims to provide regulatory clarity for digital assets by dividing oversight between the SEC and CFTC based on the nature of the asset and its underlying blockchain.

The bill introduces new criteria for determining whether a blockchain is "functional" and "decentralized," which impacts regulatory classification.

FIT21 offers specific exemptions for tokenized securities, potentially easing the regulatory burden for certain digital asset offerings.

New registration and disclosure requirements are introduced for digital asset issuers and market participants.

The bill could significantly impact real-world tokenization projects in private equity, real estate, and sports team ownership, potentially increasing accessibility and liquidity.

Challenges remain, including potential market fragmentation and implementation hurdles.

I. Introduction

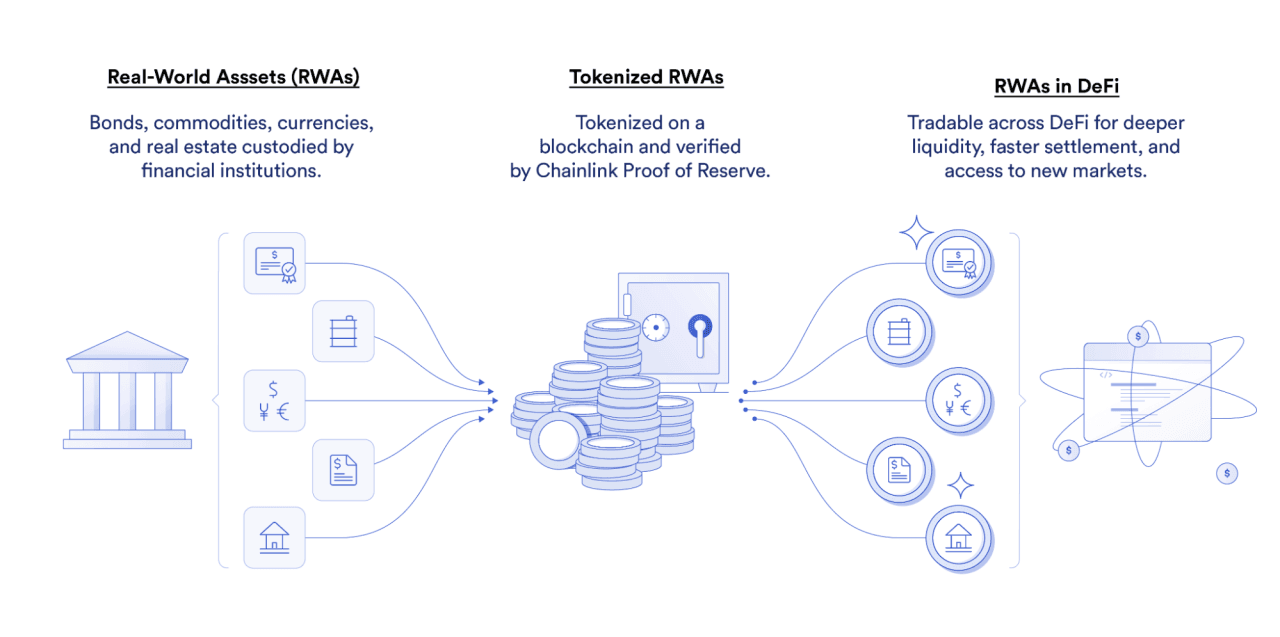

The tokenization of assets has been hailed as a revolutionary development in finance, promising to increase liquidity, accessibility, and efficiency across various markets. However, the regulatory landscape for these digital representations of value has been murky at best, hindering widespread adoption and innovation. Enter the Financial Innovation and Technology for the 21st Century Act (FIT21), a landmark piece of legislation that aims to bring clarity and structure to the world of digital assets. This article will delve into the key provisions of FIT21, explore its potential impact on various tokenization projects, and compare the regulatory landscape before and after its implementation.

II. Overview of FIT21

A. Purpose and Scope

FIT21 represents a significant stride towards comprehensive digital asset regulation in the United States. Introduced to provide a clear regulatory framework, the bill aims to address the longstanding uncertainties that have plagued the digital asset ecosystem. As stated by the House Financial Services Committee's Chairman, Patrick McHenry (R-NC), FIT21 is designed to "provid[e] the regulatory clarity and robust consumer protections necessary for the digital asset ecosystem to thrive in the United States." (https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=409277)

The primary objectives of FIT21 are:

To establish clear and effective federal requirements for digital asset markets

To provide regulatory clarity for market participants

To ensure robust consumer protection

To enable the digital asset ecosystem to flourish in the U.S.

B. Key Provisions

FIT21 introduces several key provisions that aim to reshape the regulatory landscape for digital assets:

Regulatory Classification: The bill divides digital assets into two main categories: "Restricted Digital Assets" regulated by the Securities and Exchange Commission (SEC), and "Digital Commodities" regulated by the Commodity Futures Trading Commission (CFTC).

Asset Classification: FIT21 introduces two main categories of digital assets:

"Restricted Digital Assets" regulated by the SEC

"Digital Commodities" regulated by the CFTC

Blockchain Certification Process: FIT21 establishes a process for certifying blockchain systems as "functional" and "decentralized," which impacts the regulatory classification of associated digital assets.

Exemptions: The bill provides various exemptions from securities registration for certain digital asset transactions.

Registration and Disclosure Requirements: New requirements are introduced for digital asset issuers and market participants.

Consumer Protection Measures: FIT21 mandates comprehensive customer disclosure, asset safeguarding, and operational requirements for entities registered with the CFTC and/or SEC.

As stated in the bill, "The Commodity Futures Trading Commission (CFTC) must regulate a digital asset as a commodity if the blockchain, or digital ledger, on which it runs is functional and decentralized. The Securities and Exchange Commission (SEC) must regulate a digital asset as a security if its associated blockchain is functional but not decentralized." (https://www.davispolk.com/insights/client-update/crypto-market-structure-bill-draws-closer-floor-vote-house)

III. Regulatory Classification Process

A. CFTC vs. SEC Jurisdiction

One of the most significant aspects of FIT21 is its attempt to delineate clear jurisdictional boundaries between the CFTC and SEC. This has been a major source of confusion and contention in the digital asset space, with many assets falling into a regulatory gray area.

Under FIT21, the classification of a digital asset as either a "Digital Commodity" or a "Restricted Digital Asset" depends primarily on three factors:

Whether the asset's underlying blockchain has been certified as a "decentralized system"

How the asset was acquired

Whether the asset holder is an affiliate of, or related to, the issuer

B. Criteria for "Functional" and "Decentralized" Blockchains

FIT21 introduces specific criteria for determining whether a blockchain is "functional" and "decentralized." These definitions are crucial as they directly impact the regulatory classification of associated digital assets.

Functional Blockchain:

A blockchain system is considered functional under FIT21 if it allows network participants to:

Transmit and store value on the blockchain system

Participate in services provided by or applications running on the blockchain system

Participate in the governance system of the blockchain

Decentralized Blockchain:

A blockchain system is considered decentralized if it meets five conditions:

Control: No person has had unilateral authority to control the functionality or operation of the blockchain for 12 months prior to certification.

Voting: No digital asset issuer or affiliated person has beneficially owned 20% or more of the voting power for 12 months prior to certification.

Functionality: The blockchain must be "functional" as defined above.

Development: Recent changes to the source code and marketing activities are considered.

Governance: The distribution of voting power in any decentralized governance system is evaluated.

C. Comparison with Pre-FIT21 Regulatory Landscape

Before FIT21, the regulatory landscape for digital assets was characterized by:

Regulatory Uncertainty: There was no clear framework for determining whether a digital asset was a security or a commodity.

Howey Test Dominance: The SEC primarily relied on the Howey Test to determine if a digital asset was a security, which many argued was not well-suited for blockchain-based assets.

Limited Pathways to Non-Security Status: There was no clear process for a digital asset initially classified as a security to transition to non-security status, even if the network became more decentralized over time.

Lack of Specific Decentralization Criteria: While "decentralization" was often discussed, there were no specific, codified criteria for what constituted a decentralized network in regulatory terms.

FIT21 addresses these issues by providing a clear framework for classification and introducing specific, measurable criteria for determining decentralization. This represents a significant shift from the previous regulatory environment, potentially offering greater clarity and certainty for digital asset projects.

IV. Exemptions for Tokenized Securities

FIT21 introduces several important exemptions for tokenized securities, which could significantly impact the regulatory landscape for digital asset offerings. These exemptions aim to provide more flexibility while maintaining investor protections.

A. End User Exemption

FIT21 establishes an exemption for "end user distributions" which would not be deemed securities and thus not require SEC registration. According to the bill, "An end user distribution would not be deemed to be security, and thus would not be required to be registered with the SEC. End user distributions include distributions made for activities directly related to the operation of the blockchain system, including mining, validating, or staking." (https://www.kslaw.com/news-and-insights/house-passes-fit21-what-does-it-say-and-what-does-it-mean-for-digital-asset-providers)

This exemption is particularly significant for blockchain networks that rely on token distributions as part of their operational model, potentially easing regulatory burdens for many projects.

B. Transactional Exemption

FIT21 provides a transactional exemption for certain digital asset offerings. The bill states that "A transaction involving the offer or sale of units of a digital asset by a digital asset issuer would be exempt from registration if it satisfies all of the following requirements:

(i) the aggregate amount of units to be sold would be no more than $75,000,000;

(ii) when the purchase of units of a digital asset by a person (who is not an accredited investor) would be less than either 10% of the person's annual income or 10% of the person's net worth;

(iii) the purchaser would not own more than 10% of the total amount of units;

(iv) the transaction would involve a digital asset offered as part of an investment contract;" (https://www.kslaw.com/news-and-insights/house-passes-fit21-what-does-it-say-and-what-does-it-mean-for-digital-asset-providers)

This exemption could significantly reduce regulatory burdens for many digital asset projects, particularly smaller ones or those in early stages of development.

C. Decentralized Blockchain Exemption

FIT21 provides an exemption for digital assets on decentralized blockchains through a certification process. If a blockchain is certified as both functional and decentralized, the assets on it could be regulated as digital commodities rather than securities. This creates a pathway for digital assets to transition from SEC regulation to CFTC regulation as they become more decentralized over time.

D. Comparison with Pre-FIT21 Exemptions

Before FIT21, exemptions for digital asset offerings were limited and not specifically tailored to the unique characteristics of these assets. The primary exemptions available were:

Regulation D: Allowed for private placements to accredited investors.

Regulation A+: Provided a mini-IPO option with a $50 million limit.

Regulation Crowdfunding: Allowed for small offerings up to $5 million.

These exemptions often came with significant limitations or were only available to accredited investors, limiting access for retail participants.

The exemptions introduced by FIT21 are more tailored to the digital asset space, potentially providing greater flexibility and accessibility. The End User Exemption, in particular, recognizes the unique operational aspects of blockchain networks. The Transactional Exemption's $75 million limit is higher than some existing exemptions, allowing for larger fundraising rounds. The Decentralized Blockchain Exemption provides a novel pathway for assets to transition regulatory regimes as they evolve.

V. Registration and Disclosure Requirements

FIT21 introduces new registration and disclosure requirements for digital asset issuers and market participants. These requirements aim to enhance transparency and investor protection in the digital asset market.

A. New Registration Categories

FIT21 creates new registration categories for digital asset participants. These new categories include:

Digital Commodity Exchanges (CFTC-regulated)

Digital Commodity Brokers and Dealers (CFTC-regulated)

Digital Asset Brokers, Dealers, and Trading Systems (SEC-regulated)

Key points include:

Dual Registration: Most crypto exchanges (referred to as "digital asset trading systems") will need to register with both the CFTC and SEC.

Provisional Registration: FIT21 offers a provisional registration process that provides certain exemptions. The bill states: "Once an entity has provisionally registered, it is exempt from SEC rules and regulations pertaining to registering as a national securities exchange, broker, dealer, or clearing agency, for activities related to a digital asset."

This new registration framework aims to provide regulatory oversight while acknowledging the unique nature of digital asset trading platforms. According to the bill, "any person may file a notice of intent to register with the CFTC as a digital commodity exchange, broker, or dealer or with the SEC as a digital asset broker, dealer, or trading system." (https://www.aoshearman.com/en/insights/house-passes-financial-innovation-and-technology-for-the-21st-century-act)

B. Disclosure Requirements for Issuers and Market Participants

FIT21 mandates comprehensive disclosure requirements for digital asset issuers and market participants. These disclosures must be made quarterly to both the CFTC and SEC, and include:

The source code for any blockchain system to which the digital asset relates

Transaction history, including how to independently access, search, and verify it

Digital asset economics

Information about the decentralized governance system

History of upgrades to the source code

Marketing activities

Issuance of digital assets

C. Comparison with Pre-FIT21 Requirements

Before FIT21, registration and disclosure requirements for digital asset market participants were less clear and not specifically tailored to the unique aspects of digital assets. Many entities operated in regulatory gray areas, unsure of their registration requirements.

Disclosure requirements were primarily based on traditional securities laws, which often didn't adequately address the unique aspects of digital assets and blockchain technology. This led to inconsistent and sometimes insufficient disclosures.

FIT21's new registration categories and detailed disclosure requirements represent a significant shift towards a more tailored regulatory approach for digital assets. These changes aim to provide greater clarity for market participants and enhanced transparency for investors.

VI. Case Studies: Impact on Real-World Tokenization Projects

A. Tokenized Private Equity: Jarsy

Project Description:

Jarsy is a platform that enables the tokenization of private equity investments (https://www.getjarsy.com/). It allows for fractional ownership of Pre-IPO company stocks, making these investments more accessible to a broader range of investors. Jarsy uses blockchain technology to automate various aspects of asset management, from dividend distribution to the enforcement of investor rights.

Before FIT21:

Definition: Likely classified as a security under the Howey Test.

Jurisdiction: Primarily under SEC oversight.

Registration: Full SEC registration required unless qualifying for exemptions like Regulation D or Regulation A+.

Disclosure: Standard securities disclosure requirements, not tailored to digital assets.

Exemptions: Limited to existing securities exemptions, which were not designed for digital assets.

After FIT21:

Definition: Initially classified as a "Restricted Digital Asset" under SEC jurisdiction.

Jurisdiction: Initially SEC, with potential to transition to CFTC if the underlying blockchain becomes decentralized and functional.

Registration: May need to register under new categories for digital asset exchanges, brokers, and dealers.

Disclosure: Required to provide specific disclosures about the blockchain system, transaction history, and digital asset economics.

Exemptions: Could potentially benefit from the Transactional Exemption if total sales don't exceed $75 million over 12 months and other criteria are met.

B. Tokenized Real Estate: RealT

Project Description:

RealT is a platform that allows real estate owners to tokenize their assets and sell fractional ownership to investors (https://realt.co/). Investors can purchase tokens representing ownership in specific properties and receive rental income proportional to their ownership stake.

Before FIT21:

Definition: Likely classified as a security, particularly due to the expectation of profits from rent income and asset value increase.

Jurisdiction: Primarily under SEC oversight.

Registration: Full SEC registration required unless qualifying for existing exemptions.

Disclosure: Standard real estate securities disclosure requirements.

Exemptions: Limited to existing securities exemptions, not tailored for tokenized real estate.

After FIT21:

Definition: Initially classified as a "Restricted Digital Asset" under SEC jurisdiction.

Jurisdiction: Initially SEC, with potential for dual oversight by SEC and CFTC if considered a "mixed digital asset".

Registration: May need to register under new categories for digital asset exchanges, brokers, and dealers.

Disclosure: Required to provide specific disclosures about the blockchain system, asset economics, and real estate-specific information.

Exemptions: Could potentially qualify for the Transactional Exemption if meeting the criteria, potentially reducing regulatory burden.

In all three cases, FIT21 provides more regulatory clarity and potentially more flexible pathways for compliance. However, it also introduces new registration and disclosure requirements that these projects would need to navigate carefully.

VII. Conclusion

A. Summary of Key Impacts

FIT21 represents a significant step towards comprehensive digital asset regulation in the United States. Its key impacts include:

Regulatory Clarity: Delineates responsibilities between SEC and CFTC based on blockchain functionality and decentralization. (https://www.davispolk.com/insights/client-update/crypto-market-structure-bill-draws-closer-floor-vote-house)

Tailored Exemptions: Introduces exemptions suited to digital assets, potentially reducing regulatory burdens.

Enhanced Disclosure: Mandates specific disclosures, increasing market transparency. (https://www.kslaw.com/news-and-insights/house-passes-fit21-what-does-it-say-and-what-does-it-mean-for-digital-asset-providers)

Evolutionary Framework: Allows digital assets to transition between regulatory regimes as they mature.

Consumer Protection: Introduces measures for customer protection and conflict reduction. (https://financialservices.house.gov/news/documentsingle.aspx?DocumentID=409277)

B. Future Outlook for Tokenized Assets under FIT21

FIT21 could potentially:

Accelerate innovation across various sectors.

Increase market participation from institutional and retail investors.

Enhance U.S. global competitiveness in digital assets.

Foster a more mature, transparent digital asset market.

In conclusion, while FIT21 faces hurdles, it marks a significant step towards a regulatory environment that balances innovation with necessary protections in the digital asset space. Its progress and potential impact will be closely monitored by industry stakeholders.

Recommended articles