Chunyang Shen

Oct 11, 2024

Explore how RWA bonds treasury tokenization crypto projects are revolutionizing finance in 2024, offering increased liquidity, fractional ownership, and new investment opportunities in the rapidly growing $16 trillion tokenized asset market."

Key Takeaways

RWA tokenization is transforming traditional finance by bringing real-world assets, particularly bonds and treasury securities, onto the blockchain.

The global market for tokenized assets is projected to reach $16 trillion by 2030, with bonds and treasury securities expected to account for $1.5 trillion by 2025.

Leading projects like Ondo Finance, Matrixdock, and Centrifuge are pioneering innovative solutions for tokenizing fixed-income assets, catering to both institutional and retail investors.

Benefits of RWA tokenization include increased liquidity, fractional ownership, 24/7 trading, and reduced costs.

Challenges remain in scalability, security, and regulatory compliance, but these also present opportunities for further innovation in the space.

In 2024, the landscape of finance is undergoing a profound transformation through the emergence of Real-World Asset (RWA) tokenization, particularly in the realm of bonds and treasury securities. This article explores the cutting-edge crypto projects at the forefront of RWA bonds treasury tokenization, a revolutionary concept that's reshaping traditional financial markets. By leveraging blockchain technology and decentralized finance (DeFi) principles, these projects are unlocking new levels of liquidity, accessibility, and efficiency in the world of fixed-income investments.

What is RWA Tokenization?

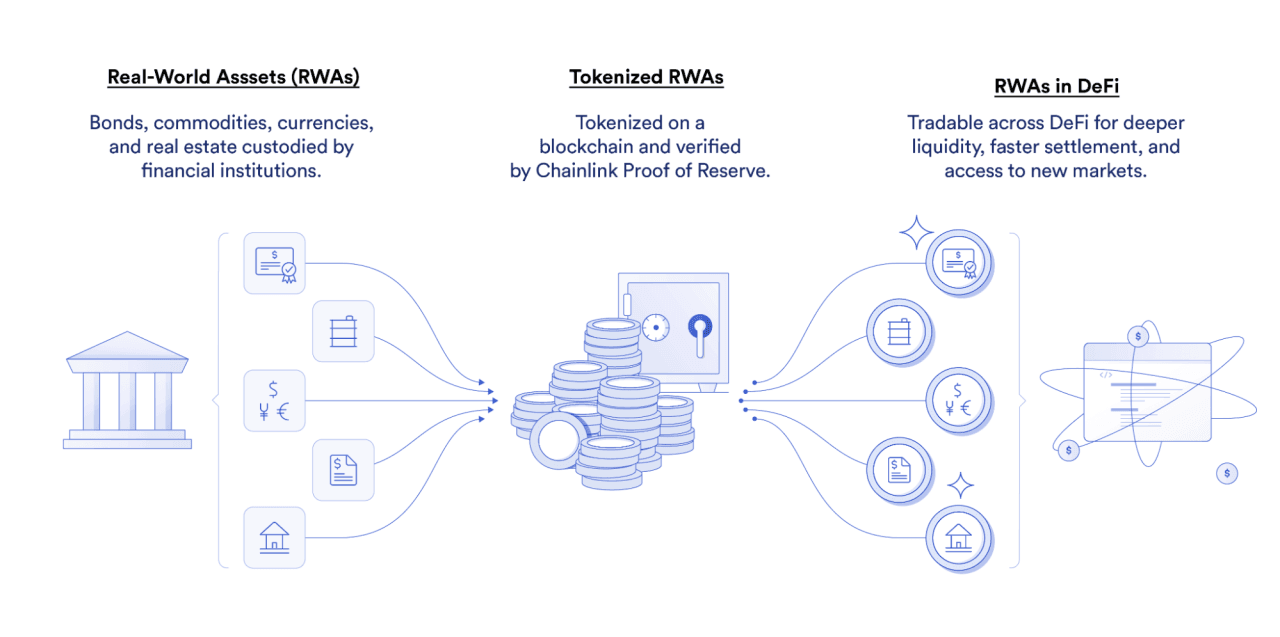

Real-World Asset (RWA) tokenization refers to the process of creating digital representations of physical or traditional financial assets on a blockchain. This innovative approach allows for the fractional ownership of assets that were previously indivisible or illiquid. In the context of bonds and treasury securities, tokenization opens up a world of possibilities for both issuers and investors.The benefits of RWA tokenization are numerous:

Increased liquidity: Tokenized assets can be traded 24/7 on global markets.

Fractional ownership: Investors can purchase small portions of high-value assets.

Accessibility: Lower barriers to entry for retail investors.

Transparency: Blockchain technology provides an immutable record of ownership and transactions.

While RWA tokenization can be applied to various asset classes such as real estate, art, and commodities, the focus on bonds and treasury securities is particularly exciting due to their fundamental role in global finance.

The Rise of Bond and Treasury Tokenization

Bonds and treasury securities are prime candidates for tokenization due to their inherent characteristics and market size. The global bond market is estimated to be worth over $100 trillion, presenting an enormous opportunity for innovation and efficiency gains through tokenization.Advantages of tokenized bonds and treasury securities include:

24/7 trading: Unlike traditional markets, tokenized bonds can be bought and sold around the clock.

Faster settlement: Blockchain technology enables near-instantaneous settlement of trades.

Lower fees: Reduced intermediaries lead to cost savings for issuers and investors.

Increased efficiency: Smart contracts automate processes like coupon payments and maturity redemptions.

Use cases for tokenized bonds and treasury securities are expanding rapidly within the DeFi ecosystem:

Lending and borrowing: Tokenized bonds can be used as collateral in DeFi protocols.

Portfolio diversification: Crypto investors can easily add fixed-income exposure to their portfolios.

Access to new markets: Emerging market bonds become more accessible to global investors.

Leading RWA Bond and Treasury Tokenization Projects in 2024

Ondo Finance

Ondo Finance has established itself as a frontrunner in the RWA tokenization space, with a particular focus on bringing institutional-grade financial products to the blockchain. Their platform effectively bridges the gap between traditional finance (TradFi) and decentralized finance (DeFi) by tokenizing real-world assets, including government bonds and treasury securities.Key features of Ondo Finance include:

OUSG token: Represents tokenized exposure to short-term U.S. Treasuries, providing a low-risk, yield-generating asset for crypto investors.

USDY token: A yield-bearing stablecoin backed by a diversified portfolio of short-term bonds, offering stability and returns.

Institutional-grade custody and compliance solutions, ensuring adherence to regulatory requirements.

Recent developments showcase Ondo's growing influence:

Partnership with Coinbase Prime for institutional custody services, enhancing security and trust.

Launch of a tokenized money market fund on both Ethereum and Polygon networks, expanding accessibility.

Total Value Locked (TVL) in Ondo's products reached $320 million as of Q3 2024, a 215% increase year-over-year.

Tokenomics:

ONDO token: Serves as the governance token for the Ondo DAO, with a total supply of 10 billion tokens.

Token distribution: 2% for community access sales, 52.1% for ecosystem growth, 33% for protocol development, and 12.9% for private sales.

Ondo Finance's strength lies in its team's background, which includes veterans from Goldman Sachs's Digital Assets team. This expertise in traditional finance, combined with a deep understanding of blockchain technology, positions Ondo uniquely to bridge the gap between TradFi and DeFi. The platform's focus on institutional-grade products and partnerships with established financial players like BlackRock adds significant credibility to their offerings.

However, Ondo faces challenges in navigating the complex regulatory landscape surrounding tokenized securities. As regulations evolve, Ondo will need to remain agile in adapting its products and compliance measures. Additionally, educating traditional investors about the benefits of tokenized assets remains an ongoing challenge.Looking ahead, Ondo Finance has the potential to significantly impact the adoption of tokenized real-world assets in the crypto space. By providing familiar, low-risk products like Treasury-backed tokens, Ondo could attract substantial institutional capital to the DeFi ecosystem. This influx of liquidity and the integration of traditional financial instruments with blockchain technology could accelerate the maturation of the crypto market and potentially lead to more sophisticated financial products and services in the DeFi space.

Matrixdock

Matrixdock, a subsidiary of Matrixport, has taken a unique approach to bond and treasury tokenization by creating a seamless bridge between traditional financial institutions and the crypto ecosystem. Their platform enables the issuance and trading of tokenized fixed-income products with a strong emphasis on regulatory compliance and security.Key offerings:

STBT (Short-Term Treasury Bill) token: Represents tokenized exposure to short-term U.S. Treasuries and reverse repurchase agreements.

XAUm token: Each token is backed by one fine troy ounce of high-grade LBMA physical gold, stored in reputable custodian vaults in Asia.

Technology highlights:

Multi-layer security architecture with cold storage solutions to protect assets.

Integration with major DeFi protocols for enhanced liquidity and interoperability.

Advanced KYC/AML procedures to ensure regulatory compliance across jurisdictions.

Recent achievements:

Successful tokenization of corporate bond offerings for blue-chip companies, totaling over $500 million in value.

Creation of a tokenized ETF tracking U.S. Treasury bonds, attracting $150 million in assets under management within the first quarter of launch.

Integration of Chainlink's full suite of tokenized RWA infrastructure, enhancing data synchronization, cross-chain liquidity, and asset transparency.

Future roadmap:

Expansion into emerging market sovereign debt tokenization, targeting $1 billion in tokenized assets by end of 2025.

Development of cross-chain interoperability for tokenized bond trading, leveraging Chainlink's CCIP technology.

Matrixdock's strength lies in its robust technological infrastructure and its connection to Matrixport, a well-established digital asset financial services ecosystem. This association provides Matrixdock with significant resources and expertise in both traditional finance and crypto markets. The platform's focus on transparency and security, evidenced by its integration of Chainlink's Proof of Reserve and Data Feeds, addresses key concerns in the RWA tokenization space.One of the main challenges Matrixdock faces is scaling its offerings while maintaining the high standards of security and compliance it has set.

As the platform expands into more diverse asset classes and emerging markets, managing the complexity of different regulatory environments and ensuring the integrity of underlying assets will be crucial.The potential future impact of Matrixdock is significant. By providing a trusted platform for tokenizing a wide range of real-world assets, Matrixdock could play a pivotal role in bringing substantial liquidity from traditional finance into the crypto ecosystem. Their focus on institutional-grade products and compliance could help legitimize RWA tokenization in the eyes of regulators and traditional financial institutions, potentially accelerating the adoption of blockchain technology in global financial markets. If successful, Matrixdock could be at the forefront of a new era of financial instruments that combine the best aspects of traditional finance with the efficiency and accessibility of blockchain technology.

Centrifuge

Centrifuge stands out in the RWA tokenization landscape by catering to both institutional and retail investors. Their protocol allows for the tokenization of various real-world assets, with a strong focus on fixed-income products like bonds and invoices. Centrifuge's approach to bringing the full power of onchain finance to asset managers and investment funds has positioned it as a leader in the space.Key features:

Onchain Fund Management platform: Allows fund managers to build and manage funds entirely onchain, reducing costs and increasing efficiency.

Multi-chain strategy: Brings RWAs to users on multiple supported chains via Liquidity Pools.

Anemoy Liquid Treasury Fund: A pool providing exposure to U.S. Treasuries, launched and attracting liquidity from multiple L1 and L2 chains.

Tokenization process:

Asset originators submit documentation and collateral.

Centrifuge protocol mints NFTs representing the asset.

NFTs are used to mint fungible tokens that can be traded or used in DeFi applications.

Recent developments:

Launch of the RWA Summit event series, bringing together builders and experts in the space across global locations.

Implementation of protocol fees, making Centrifuge a revenue-generating protocol governed by token holders.

Partnerships with major players like Gnosis DAO and Celo for RWA investments.

Underlying technology:

Built on Polkadot for enhanced scalability and interoperability.

Integration with Chainlink oracles for real-time price feeds and secure cross-chain communication.

Centrifuge's strength lies in its comprehensive approach to RWA tokenization, addressing the needs of both institutional and retail investors. The team's focus on creating a full ecosystem around tokenized assets, from fund management to cross-chain liquidity, sets it apart from more narrowly focused competitors. The successful launch of products like the Anemoy Liquid Treasury Fund demonstrates the platform's ability to bring innovative financial products to market quickly.

One of the main challenges Centrifuge faces is managing the complexity of its multi-chain strategy while ensuring security and regulatory compliance across different blockchain ecosystems. As the platform expands to support more asset types and blockchain networks, maintaining consistency in user experience and asset integrity will be crucial.The potential future impact of Centrifuge is substantial. By providing a comprehensive platform for tokenizing and managing real-world assets onchain, Centrifuge could play a pivotal role in bridging traditional finance with DeFi. The platform's focus on fund management and cross-chain liquidity could attract significant institutional capital to the DeFi space, potentially leading to a more diverse and robust ecosystem of tokenized assets. If successful, Centrifuge could help establish new standards for how real-world assets are managed and traded in the digital age, potentially revolutionizing areas like supply chain finance, real estate investment, and traditional fund management.

The Future of RWA Bond and Treasury Tokenization

Market Trends and Growth Projections

The RWA tokenization market is experiencing explosive growth, with projections indicating a potential market size of $16 trillion by 2030, according to a report from the Boston Consulting Group. Specifically for bonds and treasury securities, the tokenization market is expected to reach $1.5 trillion by 2025, representing a significant portion of the overall fixed-income market.Key statistics:

80% of institutional investors plan to increase their allocation to tokenized assets in the next five years.

The number of tokenized bond offerings grew by 300% in 2023 compared to the previous year.

Over $10 billion in tokenized treasury securities were traded on decentralized exchanges in Q1 2024.

The potential for mass adoption is driven by several factors:

Increasing regulatory clarity in major financial jurisdictions.

Growing interest from traditional financial institutions in blockchain technology.

Demand for more efficient and accessible investment options from retail investors.

Challenges and Opportunities

While the future of RWA bond and treasury tokenization looks promising, several challenges need to be addressed:

Scalability: Blockchain networks must be able to handle high transaction volumes for widespread adoption.

Security: Robust measures are needed to protect against smart contract vulnerabilities and cyberattacks.

Regulatory hurdles: Compliance with evolving securities laws across different jurisdictions remains complex.

However, these challenges also present opportunities for innovation:

Development of layer-2 scaling solutions to improve transaction throughput.

Advancements in multi-party computation and zero-knowledge proofs for enhanced security.

Creation of standardized frameworks for compliant tokenization across borders.

The impact on global financial markets could be transformative:

Increased liquidity in traditionally illiquid markets.

Democratization of access to high-quality fixed-income investments.

Reduction in settlement times and counterparty risks.

Enhanced transparency and price discovery mechanisms.

Conclusion

RWA bonds treasury tokenization crypto projects are at the forefront of a financial revolution in 2024. By leveraging blockchain technology and DeFi principles, these projects are unlocking new levels of efficiency, accessibility, and innovation in the fixed-income market. As regulatory frameworks evolve and institutional adoption grows, we can expect to see tokenized bonds and treasury securities become an integral part of the global financial ecosystem.

The potential benefits for investors, issuers, and the broader economy are substantial. From increased liquidity and fractional ownership to automated processes and reduced costs, RWA tokenization is poised to reshape how we interact with traditional financial assets.

As we look to the future, it's clear that the convergence of TradFi and DeFi through RWA tokenization will continue to accelerate. For those interested in staying ahead of the curve, now is the time to explore these innovative projects, understand their potential impact, and consider how tokenized bonds and treasury securities might fit into your investment strategy or business model.

The world of finance is changing rapidly, and RWA tokenization is leading the charge. Don't miss out on this transformative opportunity to be part of the future of finance.

Recommended articles