Chunyang Shen

Aug 3, 2024

Explore the comparison between USDC and USDT, understand the stability of stablecoin, and delve into the world of digital currency.

Exploring the digital currency landscape is a significant task, with terms like "stablecoin" frequently surfacing in discussions, particularly while examining popular examples such as USDC and USDT.

These two influential entities have created a unique blend of conventional finance with the innovative world of decentralized finance (DeFi), offering a source of stability in what can be a volatile market.

Let's concentrate on USD Coin (USDC) for a moment—an exception due to its determined pledge to being anchored securely to the U.S. dollar, distinguishing it from the masses.

Throughout our journey across cryptocurrency exchanges and maneuvering through digital wallets, we've learned just how essential stability and transparency are—not just for investors but for everyday individuals as well.

Our comprehensive exploration of blockchain technology has highlighted why USDC stands out: its dependable backing by U.S. dollars and assets listed in dollars—something not all stablecoins can assert with confidence.

So, shall we embark on this discovery together?

Key Takeaways

USD Coin (USDC) is a stablecoin that always aims to maintain its value equal to one U.S. dollar and is fully backed by U.S. dollars and dollar-denominated assets. Circle, a reputable company in the crypto market, issues USDC.

Tether (USDT), another popular stablecoin pegged to the U.S. dollar since 2014, has faced transparency issues about its reserves, unlike USDC which undergoes regular audits confirming it's backed 1:1 with U.S. dollars.

Since its debut in 2018 on the Ethereum blockchain, USDC has expanded across multiple platforms including Solana and Binance Smart Chain, enhancing its utility and adoption within the cryptocurrency markets.

Regulatory compliance plays a significant role in the trustworthiness of stablecoins; USDC complies with laws set by financial authorities while offering high liquidity due to being accepted across various exchanges worldwide.

Transaction speed varies between USDT and USDC due to their operations on different blockchains; however, many users find USDC reliable for quick transfers because of its transparent backing by real-world assets such as U.S. dollars and its presence on multiple blockchains ensures wide accessibility.

Understanding Stablecoins

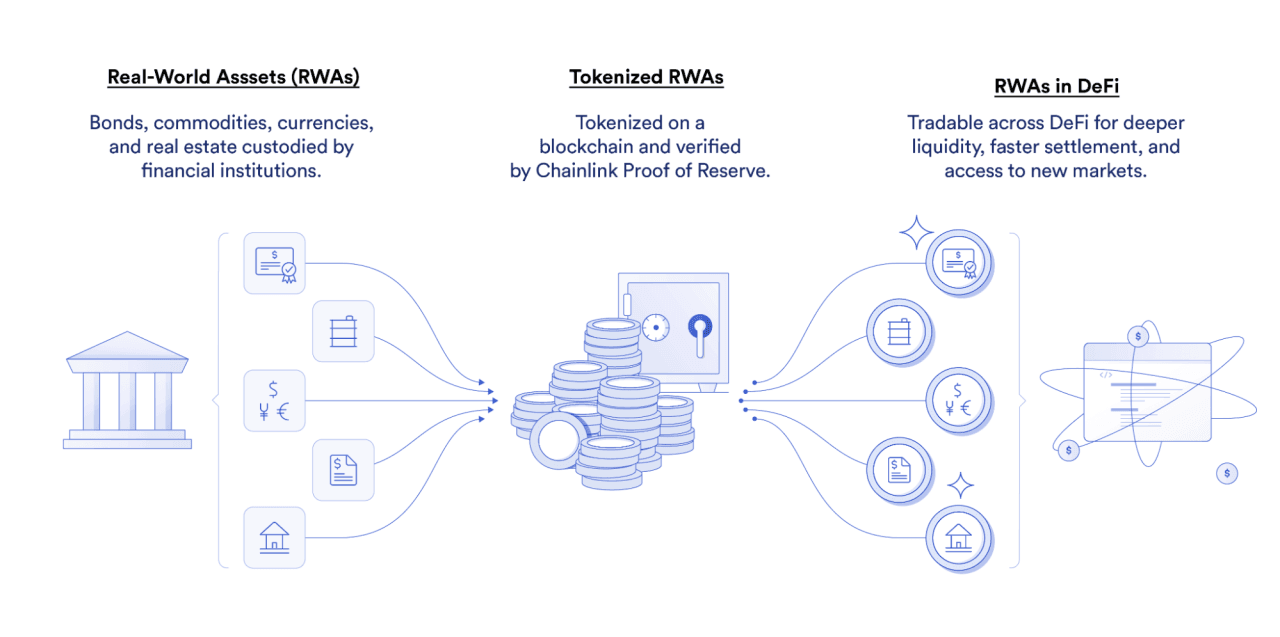

Stablecoins are like a bridge between traditional money and cryptocurrencies. They stay stable by being tied to assets such as the US dollar or gold, making them less bouncy than other digital currencies.

Definition of stablecoins

Stablecoins are types of cryptocurrencies that aim to keep their value constant at $1. This makes them different from other digital currencies whose prices can change a lot in a short time.

For example, USD Coin (USDC) is a stablecoin pegged to the U.S. dollar, meaning one USDC always strives to be equal to one United States dollar. Circle issues USDC, but it's not from the U.S. government.

We use stablecoins for trading on crypto exchanges and making cross-border payments easier because they don't change in value like Bitcoin or Ethereum might. They're based on blockchains such as Ethereum and Solana and support various uses like decentralized applications (dApps) and yield farming without the typical cryptocurrency risks of high volatility.

Since launching in 2018, USDC has built a reputation for being transparent and safe within the crypto community.

Advantages of stablecoins

Stablecoins provide several benefits that make them appealing in cryptocurrency. They offer a stable value, typically pegged to a fiat currency like the U.S. dollar, meaning one USDC is intended to maintain a value of $1.

This stability helps users avoid the high volatility seen with many other crypto assets. With USDC fully backed by U.S. dollars and dollar-denominated assets, we can have greater confidence in its reliability compared to alternatives.

Using stablecoins simplifies transactions among decentralized exchanges and traditional payment methods like PayPal or credit cards. Liquidity pools often include these coins due to their dependable nature, making it easier for us to trade without worrying about sudden price swings.

As USD Coin (USDC) debuted on the Ethereum blockchain in 2018 and expanded to multiple platforms since then, its growing adoption reflects our increasing demand for safer digital currencies within crypto trading environments.

The goal of stablecoins is to mimic traditional fiat currencies while benefiting from blockchain technology.

Reasons for the rise of USD stablecoins

The rise of USD stablecoins, like USDC, stems from their ability to provide stability in the volatile cryptocurrency market. These stablecoins are pegged to the U.S. dollar, ensuring that one USDC equals $1.

This predictability attracts users who want to avoid price fluctuations common with other cryptocurrencies. Moreover, as USD Coin debuted in 2018 and gained traction on various blockchain platforms, its backing by dollar-denominated assets has positioned it as a safer alternative for many investors.

Regulatory compliance also plays a role in this growth. Many users seek transparency and security when using virtual currencies. USDC's clear reserves and regular audits increase trust among participants compared to alternatives like Tether (USDT).

The confidence in using USDC is rising alongside interest rates and inflation concerns affecting traditional money markets. Understanding these factors can help us navigate our choices better when considering different stablecoins available today.

Factors for determining a safe stablecoin

A safe stablecoin offers reliability and transparency to users. We can look at several key factors that help us determine how safe a stablecoin, like USD Coin (USDC), really is.

Backing Assets

A stablecoin must be fully backed by U.S. dollars or dollar-denominated assets. USDC meets this criterion, ensuring that every coin is supported by real value. This backing creates confidence in its stability.

Issuing Entity

The organization behind the stablecoin plays a crucial role in its safety. USDC is issued by Circle, a reputable company known for its commitment to transparency and security in cryptocurrency trading.

Transparency

Regular audits are essential for trustworthiness. USDC undergoes frequent third-party audits that confirm it is indeed backed 1:1 with U.S. dollars. This openness sets it apart from other options like Tether (USDT).

Regulatory Compliance

Compliance with regulations enhances safety for users. USDC follows relevant laws and guidelines set by financial authorities, creating an additional layer of security compared to some other stablecoins.

Volume and Liquidity

A higher trading volume usually indicates better liquidity, making it easier to buy or sell the coin quickly without affecting its price significantly. Both USDT and USDC have substantial market caps, but understanding their liquidity helps us gauge their safety.

Blockchain Transparency

The blockchain on which the stablecoin operates can impact its safety features. USDC debuted on the Ethereum blockchain, which allows users to track transactions transparently and securely.

Speed of Transfers

Transaction speed matters when we want quick access to funds or trades; slower transfers can hamper efficient trading experiences in cryptocurrency markets.

Reserve Policies

Knowing how the reserves are managed adds clarity about stability risks involved with a stablecoin's overall value maintenance efforts in financial crises or downturns.

Community Trust

User sentiment can provide insights into a coin's reliability over time. Community discussions often highlight strengths or weaknesses perceived among various stablecoins, including USDC’s reputation as a safer option.

Investment Strategy Support

Some investors view specific stablecoins as long-term holdings within diverse portfolios; understanding their strategies related to coins like USDC builds familiarity before entering cryptocurrency trading environments effectively.

These factors combined give us a clearer picture of what makes a stablecoin like USDC reliable in today's digital currency landscape while also differentiating it from alternatives such as Tether (USDT).

Comparison: USDT vs USDC

In our comparison of USDT and USDC, we will explore their key features and differences. We’ll look at Tether's volume, market cap, and overall stability. Then we will shift to USD Coin to examine its performance in the same areas.

By understanding these aspects, we can better decide which stablecoin suits our needs. Join us as we break down these two popular options further!

Overview of Tether (USDT)

Tether (USDT) is one of the most recognized stablecoins in cryptocurrency. It was launched in 2014 by Tether Limited and aims to maintain a value equal to one U.S. dollar (USD). This means that for every USDT issued, there should theoretically be an equivalent amount of dollars held in reserve.

USDT has gained significant popularity, boasting a large market cap and high trading volume across various exchanges like Bitfinex and Poloniex.

Despite its widespread use, concerns about the stability of USDT exist. The lack of transparency regarding its reserves has led some users to question how secure it truly is as a stablecoin.

Tether often uses different financial instruments for backing including repurchase agreements and corporate bonds, which can introduce risks not present with more transparent assets like treasury bills or money market funds used by other stablecoins such as USD Coin (USDC).

Volume and market cap of USDT

The trading volume and market cap of Tether (USDT) make it one of the most significant stablecoins in the cryptocurrency space. As of now, USDT has a market capitalization that often exceeds $68 billion.

This vast amount shows its popularity among traders and investors who seek stability amidst price fluctuations in the crypto markets. Daily trading volumes frequently reach over $30 billion, indicating strong liquidity.

For those new to cryptocurrencies, high volume means we can buy or sell USDT easily without affecting its price much. This makes it an attractive option for our transactions and trades within exchanges like Coinbase or Binance.

Since it's pegged to the U.S. dollar, USDT aims to maintain a value around $1, providing us with a reliable way to manage our digital assets while minimizing volatility risks associated with other cryptocurrencies.

Stability of USDT

USDT, also known as Tether, aims to maintain stability by pegging its value to the U.S. dollar. Each USDT is designed to equal $1. This peg is crucial for users who need a reliable medium of exchange within the volatile crypto market.

However, there have been concerns about the actual reserves backing USDT, which can affect perceptions of its stability.

Although USDT claims to be fully backed by assets equivalent to its circulation, transparency issues persist. Reports suggest that only a portion of these reserves are in cash or cash equivalents.

Such uncertainties can lead investors to question how stable it truly is when compared with other coins like USD Coin (USDC), which has garnered attention for its greater transparency and regulatory compliance in the cryptocurrency landscape.

Overview of USD Coin (USDC)

USD Coin (USDC) is a stablecoin launched in 2018. It is fully backed by U.S. dollars and dollar-denominated assets. We find that one USDC maintains a value of $1, making it reliable for transactions and trading.

Issued by Circle, USDC allows users to engage with blockchain networks easily. This coin operates on various platforms like Ethereum as an ERC-20 token, expanding its reach in the cryptocurrency market.

Many consider USDC a safer choice than other stablecoins due to its transparency and regulatory compliance. Regular audits ensure that every USDC is backed by real reserves, which helps us feel secure when using it for virtual currency exchanges or investments.

As we explore options like mobile apps for transactions or integrating services such as Apple Pay and Google Pay, understanding how safe USDC is remains crucial for our crypto journey.

Volume and market cap of USDC

The market cap of USD Coin (USDC) plays a significant role in its acceptance within the cryptocurrency community. USDC has gained considerable traction since its debut in 2018 on the Ethereum blockchain.

It is now available across multiple platforms, which contributes to its growing volume and popularity. As a stablecoin fully backed by U.S. dollars and dollar-denominated assets, it maintains a value designed to equal $1.

Currently, USDC's market cap ranks among the top stablecoins, demonstrating strong demand for this fiat-collateralized asset. Many users view it as a safer choice compared to Tether (USDT), mainly due to USDC's emphasis on transparency and regular audits.

This reassurance attracts both new investors and experienced traders seeking stability in their crypto portfolios while engaging with different markets like Binance Smart Chain or exploring options such as Gemini or OKEx for trading these crypto tokens effectively.

Stability of USDC

USD Coin (USDC) aims to maintain a stable value of $1. Each USDC is fully backed by U.S. dollars and dollar-denominated assets, providing assurance to users. This backing helps instill confidence in its stability compared to other options like Tether (USDT).

Transparency plays a crucial role; USDC benefits from regular audits that confirm its reserves.

We launched USDC in 2018 on the Ethereum blockchain, showcasing our commitment to reliable currency use within the crypto community. As demand for USD stablecoins has grown, so has interest in USDC as a safe alternative for transactions and investments.

The consistent value relative to physical currency enhances trust among both businesses and individual users exploring cryptocurrencies.

Key Differences between USDT and USDC

USDT and USDC have different launch dates, which affects their development and user adoption. They also vary in the assets that back them, impacting their trustworthiness and market performance.

Launch date

USD Coin (USDC) debuted in 2018 on the Ethereum blockchain. It is now accessible across various platforms, growing its utility and reach within the cryptocurrency market. This stablecoin stands out as it aims to maintain a value of $1, making it an attractive option for those looking to transact with digital assets that reflect the dollar's stability.

Understanding how USDC fits into the larger landscape of stablecoins helps us discern its place alongside others like Tether (USDT). Let’s explore what makes USDC unique compared to USDT.

Reserve assets

Reserve assets play a crucial role in the stability of stablecoins like USD Coin (USDC) and Tether (USDT). USDC is backed by U.S. dollars and dollar-denominated assets, ensuring that every USDC issued can be exchanged one-to-one for a dollar.

This backing helps maintain its value at $1. On the other hand, Tether's reserve practices have faced scrutiny over time, raising questions about their full transparency.

Both stablecoins aim to provide users with reliable digital currencies pegged to the U.S. dollar. Despite this, we view USDC as a safer option because of its clear audit trails and assurances regarding reserve assets.

The transparency surrounding these reserves gives us added confidence in using USDC in our transactions within the cryptocurrency market alongside other popular options like Binance USD (BUSD) or TerraUSD.

Trade and liquidity volume

Trade and liquidity volume play crucial roles in the performance of stablecoins like USDC and USDT. Both are widely used within the crypto community, but there are distinctions to consider.

As of now, Tether (USDT) holds a significantly higher trading volume compared to USD Coin (USDC). This larger trade volume indicates stronger market activity for USDT. However, we view USDC's growing liquidity as a positive sign for its future stability.

The total market cap of USDC has been on the rise since its launch in 2018, reflecting increasing trust among users. Transparency is one of the key attributes that many consider important when evaluating safe stablecoins like USDC.

It provides regular attestations about reserve assets backing each coin issued. These factors contribute to our understanding of how both coins operate in different market conditions while serving as fiat-collateralized stablecoins effectively.

Blockchain transparency

Blockchain transparency plays a vital role in stablecoins. USD Coin (USDC) stands out because it offers clear insights into its reserves and transactions. This transparency fosters confidence with users, as we can see that USDC is fully backed by U.S. dollars and dollar-denominated assets.

Regular audits confirm that each USDC issued has an equivalent amount held in reserve, making it a safer choice compared to Tether (USDT).

Tether's lack of transparency raises concerns about its backing and financial practices. While both USDT and USDC are popular among crypto users as fiat-collateralized stablecoins, we feel assured knowing that USDC adheres to strict regulatory standards regarding reserve bank reporting and fiscal responsibility.

This commitment helps reinforce the value of the U.S. dollar within digital finance and reduces risks associated with algorithmic stablecoins or less transparent alternatives.

Speed of transfers

Speed of transfers can vary between USDT and USDC. Both stablecoins allow for quick transactions, but the underlying technology differs slightly. USDC debuted in 2018 on the Ethereum blockchain and has since expanded to other platforms.

This multi-blockchain availability often results in faster transaction times depending on network congestion.

USDT also offers swift transfers due to its integration with multiple blockchains, including TRON and Bitcoin's Omni Layer. Nevertheless, many users consider USDC to have a more reliable transfer speed because of its transparent backing by U.S. dollars and dollar-denominated assets.

Speed is essential for those wanting immediate access to their funds or wishing to take advantage of market data promptly.

Conclusion

We explored the key features of USD Coin (USDC) and compared it with Tether (USDT). Both are popular stablecoins pegged to the U.S. dollar, yet they have distinct differences in transparency and stability.

USDC is fully backed by U.S. dollars and known for its reliability, while USDT has faced scrutiny regarding its reserves.

Understanding these factors can help us make informed decisions in cryptocurrency trading. We should consider how each asset aligns with our financial goals. This knowledge empowers us to navigate the changing crypto landscape more effectively.

For those interested in learning more, plenty of resources discuss stablecoins and their broader implications. Embracing this information can lead to greater confidence in our investments.

Let’s take advantage of what we’ve learned about USDC as a viable option within the field of digital currencies!

FAQs

1. What is USDC?

USDC, or USD Coin, is a type of digital asset that has its value tied to the US dollar.

2. How safe is it to use USDC?

The safety of using USDC depends on various factors such as the underlying asset, central bank oversight and the issuance process. It's always important to understand these aspects before making a transfer.

3. What sets apart USDC from other coins like USDT?

The difference between USDC and USDT lies in their management structure and backing institutions like BlackRock for USD Coin (USDC) and BNY Mellon for Tether (USDT).

4. How long does it take to transfer my money into USDC or USDT?

Incoming USDC, USDT, or ETH transfers to your Transaction account are usually posted after ten (10) confirmations on the Ethereum blockchain. This process typically takes about 4 minutes, depending on the transaction fee selected by the sender and the current Ethereum network traffic.

5. Do I have to pay taxes when using USD Coin?

Yes, just like with paper money transactions, any gains made through trading or transacting with USD Coin are subject to taxation laws.

Recommended articles