Chunyang Shen

2024年7月17日

Special Purpose Vehicles (SPVs), a powerful tool that opens doors to high-growth opportunities. This comprehensive guide explores the ins and outs of SPV investing, from its structure and benefits to potential risks, while introducing Jarsy, an innovative platform that's making SPV investments more accessible and efficient than ever before.

Investing in pre-IPO companies via Special Purpose Vehicles (SPVs) has emerged as a compelling strategy for investors seeking access to high-growth opportunities traditionally reserved for institutional players. This comprehensive guide explores the intricacies of SPV investing, from its fundamental structure and legal setup to the step-by-step investment process. We delve into the advantages of using SPVs, such as access to exclusive deals and professional management, while also addressing potential downsides including illiquidity and fees. Furthermore, we introduce Jarsy, an innovative platform that's revolutionizing SPV investing by lowering entry barriers, enhancing transparency and liquidity through blockchain technology, and streamlining the investment process. Whether you're a seasoned investor or new to pre-IPO opportunities, this guide provides valuable insights into navigating the world of SPV investments and maximizing their potential benefits.

What is an SPV

A Special Purpose Vehicle (SPV), also known as a Special Purpose Entity (SPE), is a subsidiary company created for a specific, limited purpose. In the context of investing, an SPV is typically formed to pool capital from multiple investors to make a single investment in a target company.

Key characteristics of SPVs:

Legal separation: An SPV is a distinct legal entity from its parent company or investors.

Asset isolation: The assets and liabilities of the SPV are separate from those of the parent company.

Bankruptcy remoteness: The SPV's obligations are secure even if the parent company faces financial difficulties.

SPVs serve several crucial functions in pre-IPO investing:

Aggregation of capital: They allow smaller investors to combine their resources to reach investment minimums.

Simplification of cap tables: Companies can deal with a single entity (the SPV) rather than numerous individual investors.

Flexibility in deal structuring: SPVs can be tailored to meet specific investment requirements or restrictions.

Typical legal setup for SPV

The legal structure of an SPV is crucial to its function and benefits. Here's an overview of how SPVs are typically set up:

Legal Entity Formation:

SPVs are usually formed as Limited Liability Companies (LLCs) or Limited Partnerships (LPs).

The choice between LLC and LP often depends on tax considerations and the specific needs of the investors.

Jurisdiction:

SPVs can be domiciled in various jurisdictions, both onshore and offshore.

Common jurisdictions include Delaware (USA), Cayman Islands, and Luxembourg, chosen for their favorable legal and tax environments.

Governance Structure:

SPVs typically have a manager or general partner (GP) who makes investment decisions and handles day-to-day operations.

Investors are usually passive limited partners (LPs) or members with limited voting rights.

Operating Agreement:

This document outlines the rights and responsibilities of all parties involved.

It includes details on investment strategy, fee structure, profit distribution, and exit procedures.

Typical SPV Investment Lifecycle

Deal Sourcing:

The SPV manager identifies a promising pre-IPO company for investment.

Initial due diligence is conducted to assess the opportunity.

SPV Formation:

The legal entity is created with the appropriate structure and jurisdiction.

Necessary legal documents are prepared, including the operating agreement and subscription documents.

Investor Recruitment:

The SPV manager markets the investment opportunity to potential investors.

This may be done through existing networks, online platforms, or registered broker-dealers.

Capital Raise:

Interested investors review the offering documents and commit capital.

Funds are collected in the SPV's bank account.

Investment Execution:

The SPV manager negotiates and finalizes terms with the target company.

The investment is made, and the SPV becomes a shareholder in the target company.

Ongoing Management:

The SPV manager monitors the investment and provides regular updates to investors.

They may also assist the portfolio company with strategic guidance or connections.

Tax Management:

The SPV manager works with tax professionals to ensure proper tax treatment of the investment.

This may include managing issues like PFIC (Passive Foreign Investment Company) status for offshore SPVs.

Investors receive necessary tax documentation to report their share of the SPV's income or losses.

Exit Preparation:

As the company approaches a liquidity event (like an IPO or acquisition), the SPV manager prepares for exit.

This may involve coordinating with the company and other shareholders.

Exit Execution:

When the liquidity event occurs, the SPV sells its shares.

In an IPO scenario, there may be a lock-up period before shares can be sold.

Distribution and Dissolution:

Proceeds from the exit are distributed to investors according to the terms of the operating agreement.

Final tax documents and financial statements are prepared.

After all distributions are made and obligations met, the SPV is typically dissolved.

This process can take anywhere from a few years to a decade or more, depending on the growth trajectory of the target company and market conditions. Throughout this time, proper management of reporting, financial statements, and tax liabilities is crucial for maintaining transparency with investors and compliance with regulatory requirements.

Why should use SPV to invest pre-IPO companies

Investing through SPVs offers numerous advantages, particularly for those interested in pre-IPO companies:

Access to exclusive deals

SPVs can provide entry to high-profile investments that are usually reserved for institutional investors or high-net-worth individuals. This democratization of access allows a broader range of investors to participate in potentially high-growth opportunities.

Diversification:

By pooling resources with other investors, you can spread your risk across multiple pre-IPO opportunities. This is particularly valuable in the high-risk, high-reward world of startup investing.

Professional management:

SPVs are often managed by experienced professionals who handle:

Due diligence on potential investments

Deal negotiation and structuring

Ongoing portfolio management

Investor relations and reporting

Lower investment minimums:

SPVs allow investors to participate in deals with smaller amounts of capital than would be required for direct investment. This can be especially beneficial for angel investors or those new to pre-IPO investing.

Streamlined paperwork:

Investors deal with a single entity (the SPV) rather than managing multiple direct investments. This can significantly reduce administrative burdens and legal complexities.

Potential tax benefits:

Depending on how the SPV is structured, there may be tax advantages for investors. For example, pass-through taxation in certain structures can avoid double taxation.

Enhanced networking opportunities:

Participating in SPVs can connect investors with like-minded individuals and potentially lead to future investment opportunities.

Simplified exit process:

When it's time to sell or when the company goes public, the SPV manager handles the process, simplifying the exit for individual investors.

Downsides and Risks of SPVs

While SPVs offer unique opportunities, they also come with potential drawbacks that investors should carefully consider:

Lack of control:

Investors in SPVs typically have limited say in investment decisions, including:

Choice of investments

Timing of exits

Ongoing management decisions

Illiquidity:

Pre-IPO investments are typically illiquid, meaning investors may not be able to easily sell their stake. This can tie up capital for extended periods, sometimes years.

Fees:

SPVs often charge several types of fees, which can impact overall returns:

Management fees (typically 1-2% annually)

Carried interest (often 20% of profits)

Set-up and administrative fees

Complexity:

The legal and tax structures of SPVs can be complex and may require professional advice to fully understand. This complexity can lead to:

Unexpected tax implications

Difficulties in valuation

Challenges in understanding true exposure and risk

Limited transparency:

Investors may have restricted access to information about the underlying company. This can make it difficult to:

Assess the true value of the investment

Make informed decisions about holding or selling

Understand the company's operations and challenges

Concentration risk:

Some SPVs focus on a single investment, which can increase risk if that company underperforms. This lack of diversification within the SPV itself can amplify potential losses.

Regulatory scrutiny:

As SPVs become more popular, they may face increased regulatory oversight, which could impact their structure or availability in the future.

Potential conflicts of interest:

If the SPV manager invests in multiple deals or has other business relationships, there may be conflicts of interest that aren't immediately apparent to investors.

Execution risk:

The success of the investment heavily depends on the SPV manager's ability to:

Identify promising opportunities

Negotiate favorable terms

Manage the investment effectively over time

Market timing risk:

If the IPO market cools or the company decides not to go public, investors may face extended hold periods or reduced returns.

Maximizing SPV Benefits with Jarsy

While SPV investing offers numerous advantages, it traditionally comes with certain challenges. Jarsy, an innovative platform in the SPV space, addresses many of these issues, making SPV investing more accessible, transparent, and efficient.

Addressing the Lack of Control

Diverse Pre-IPO Opportunities: Unlike traditional SPVs that often limit investors to a single company, Jarsy offers a growing selection of pre-IPO companies on its platform. This diversity allows investors more control over their investment choices.

Expert Deal Selection: Jarsy's team of professionals carefully vets and selects the best deals, ensuring that investors have access to high-quality opportunities without needing to conduct extensive due diligence themselves.

Simplifying Complex Processes

Streamlined Digital Experience: Jarsy's platform simplifies the SPV investment process, making it as straightforward as investing in public stocks on popular apps.

Automated Paperless Reporting: Jarsy provides automatic, paperless notifications, reports, statements, and tax files within the app. This significantly reduces complexity and administrative burdens for investors.

Reduced Fees: By automating many processes, Jarsy can offer lower management fees compared to traditional SPVs, maximizing investor returns.

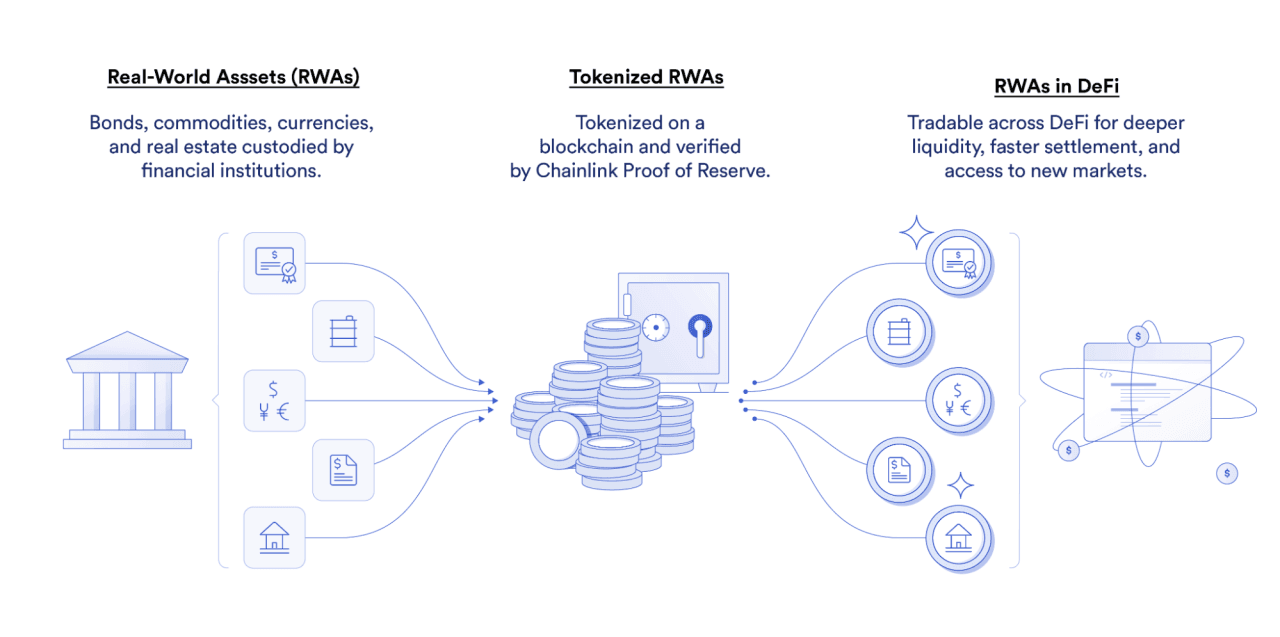

Enhancing Transparency through Blockchain

On-Chain Verification: Jarsy leverages Arbitrum blockchain technology to map share ownership to on-chain tokens. This provides transparent, immutable records of ownership.

Total Supply Visibility: The total token supply is visible on the blockchain, ensuring a 1:1 match between tokens and shares, preventing dilution or misrepresentation.

Transaction Transparency: All transactions are recorded on the blockchain, making the company's operations fully transparent and auditable.

Democratizing Access and Improving Diversification

Low Minimum Investment: Jarsy allows participants to invest with as little as $10, dramatically lowering the barrier to entry.

Fractional Ownership: Support for fractional shares enables investors to diversify their portfolio across multiple pre-IPO companies, even with limited capital.

Enhancing Liquidity

Token-Based Ownership: By tokenizing SPV ownership, Jarsy makes transferring ownership between users much easier.

Pre-Exit Trading: Jarsy plans to support ownership token transfers and trading on its platform before the underlying pre-IPO exit event. This could significantly enhance liquidity, improve market efficiency, and help investors manage risk.

Benefits of Using Jarsy for SPV Investing

Greater Control: More investment options and expert deal selection give investors better control over their portfolios.

Efficiency: Streamlined, automated processes reduce administrative burdens and costs.

Transparency: Blockchain-based ownership records and operations offer unprecedented transparency.

Accessibility: Low minimums and fractional shares open up pre-IPO investing to a much wider audience.

Diversification: The ability to invest small amounts across multiple deals allows for better risk spreading.

Enhanced Liquidity: Potential for trading tokens provides liquidity in an traditionally illiquid asset class.

In conclusion, Jarsy represents an innovative approach to SPV investing, addressing many traditional pain points and potentially opening up this asset class to a broader range of investors. By combining low minimums, fractional ownership, blockchain technology, and professional management, Jarsy aims to maximize the benefits of SPV investing while mitigating some of its challenges. However, as with any investment, potential participants should conduct thorough due diligence and consider their personal financial situation and goals before investing.

Recommended articles