Yiying Hu

2024年7月30日

Discover how to valuate SpaceX stock by analyzing key factors and learn about the key advantages of investing in SpaceX via Jarsy.

Investing in pre-IPO shares like SpaceX can be both exciting and challenging. The allure of being part of a groundbreaking company, especially one as dynamic as SpaceX, is undeniable. However, determining the value of SpaceX stock before it goes public requires careful consideration of various factors. This article will guide you through the process of valuating SpaceX stock and explain why using Jarsy for pre-IPO investments is a smart choice.

What is SpaceX Valuation?

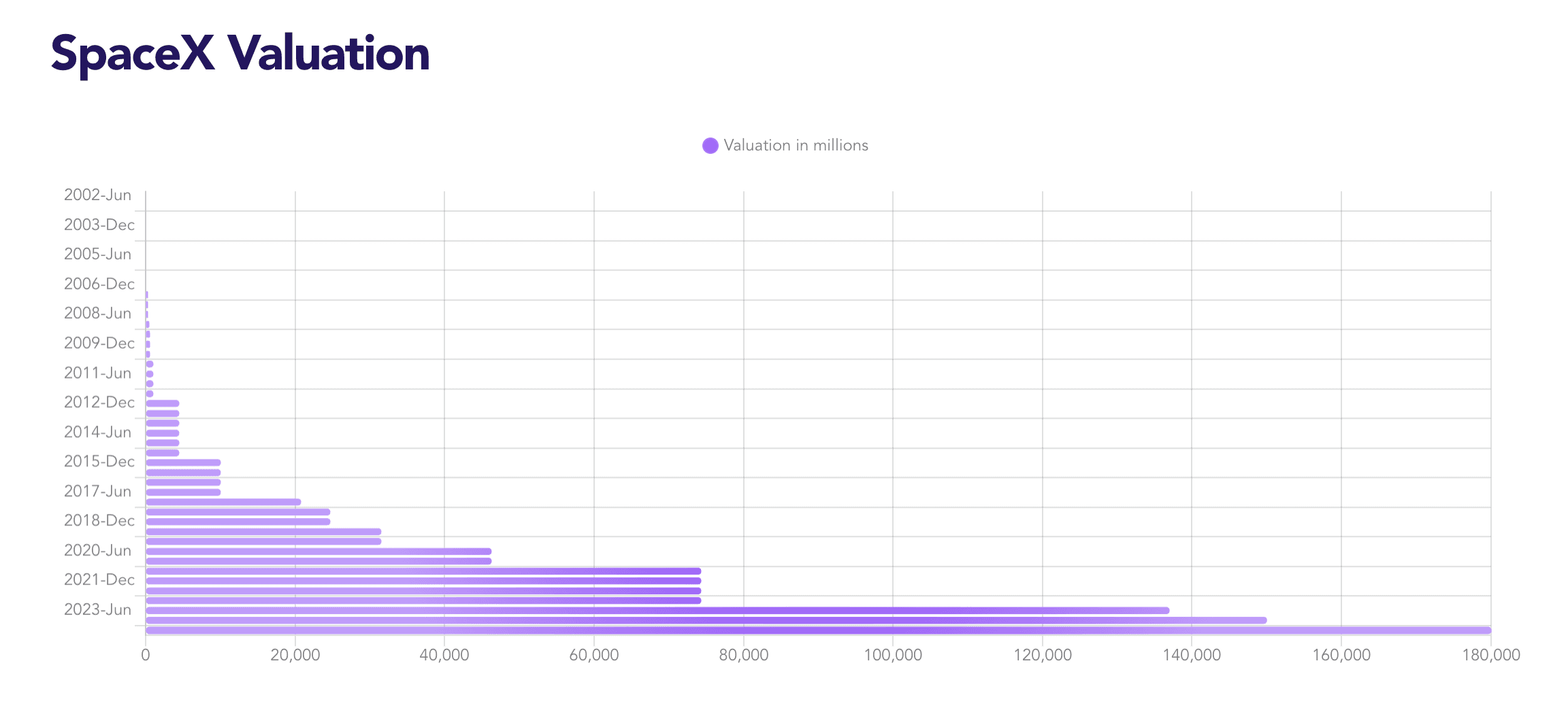

SpaceX has shown a remarkable growth trajectory over recent years. Here’s a visual representation of SpaceX's valuation over its recent funding rounds (source).

How to Price SpaceX Stock?

Evaluating SpaceX stock involves a blend of quantitative and qualitative analyses. Here are the key factors to consider:

Quantitative Factors

Last Funding Round's Price: One of the most reliable indicators of SpaceX’s valuation is the price at which it last raised private capital. As of the latest funding round in 2021, SpaceX was valued at $74 billion.

Secondary Transaction History: Historical data on the trading prices of SpaceX shares in secondary markets can provide insight into the stock’s valuation trends.

Company Financials: Although SpaceX is a private company and its financials are not publicly disclosed, information from reliable sources about its revenue, profit margins, and growth projections can be invaluable. Comparing these metrics with publicly traded competitors can also offer perspective.

Qualitative Factors

Company News: Major developments like the successful launch of the SpaceX Starship (e.g., updates on SpaceX launches in California), new contracts, or significant technological breakthroughs can positively impact the stock's perceived value. Conversely, setbacks or regulatory challenges can have a negative effect.

Regulatory Environment: Changes in space industry regulations, environmental policies, or international agreements affecting SpaceX can influence its valuation.

Market Trends: Broader trends in the aerospace industry and overall economic conditions play a role in determining the value of SpaceX stock.

Social Media: such as SpaceX Twitter.

Why Invest in SpaceX via Jarsy?

Investing in SpaceX stock via Jarsy offers several distinct advantages:

Best Prices Available: Jarsy sources pre-IPO deals at the best prices, ensuring you avoid SpaceX deals with high premiums. This means you get more value for your investment by not overpaying.

Lower Minimum Investments: Jarsy allows investors to start with as little as $10. This means you don’t need a large sum of money to own a piece of the company. It also allows for better portfolio diversification, reducing investment risk.

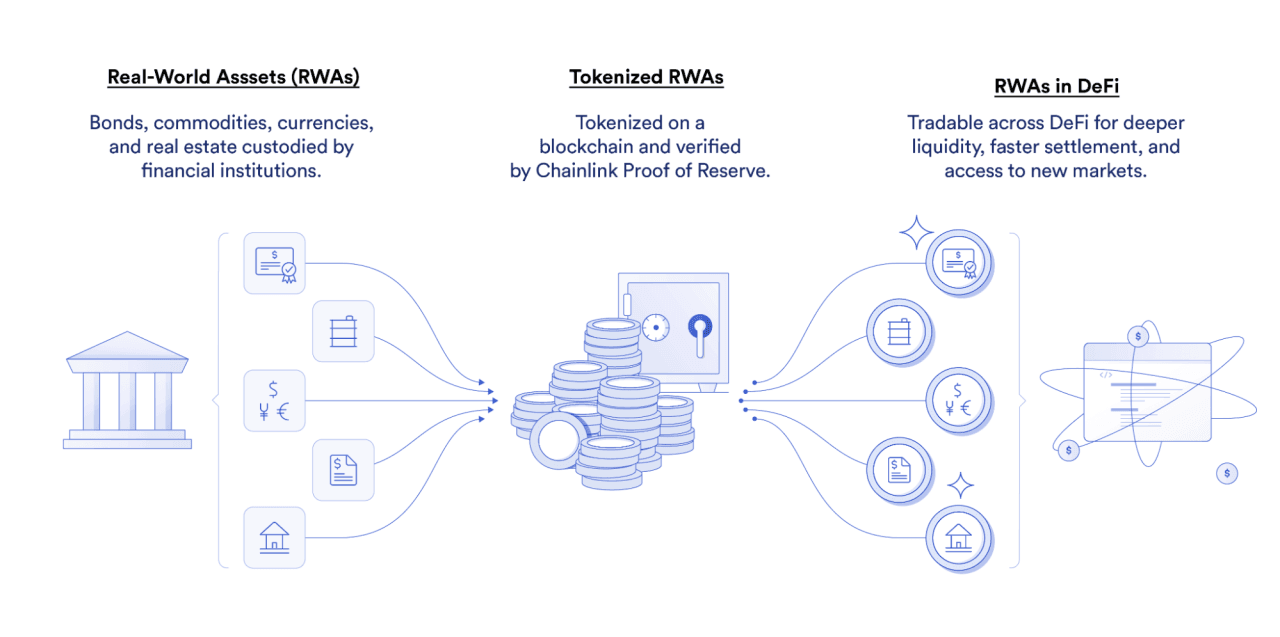

Blockchain Verification: Ownership of shares is verifiable via blockchain technology, ensuring transparency and security.

Conclusion

Evaluating SpaceX stock requires a thorough analysis of both quantitative and qualitative factors. The company’s steady growth, as evidenced by its rising valuation over the years, suggests a promising investment opportunity. By understanding the nuances of SpaceX’s valuation and leveraging the benefits offered by Jarsy, you can make informed investment decisions. Whether you’re captivated by the latest SpaceX Starship launch or intrigued by the company’s innovative trajectory, Jarsy empowers you to invest in SpaceX starting with just $10, making high-potential opportunities accessible to all.

Recommended articles