Chunyang Shen

2024年5月7日

With recent interest rate hikes, many investors are turning their attention to U.S. Treasury securities. Here is a guide of how to invest in them for U.S. and non-U.S. investors.

Introduction

These U.S. government-backed instruments offer a safe and stable investment option, appealing to those looking to preserve capital while earning a modest return. This guide will introduce different types of treasury securities, and delve into short-term securities, which Jarsy offers.

Types of Treasury Securities

Treasury Bills (T-bills): Short-term Treasury securities that mature in one year or less. They are sold at a discount and do not pay periodic interest. The interest is the difference between the purchase price and the face value paid at maturity.

Treasury Notes (T-notes): Medium-term securities that mature in two to ten years. They pay interest every six months.

Treasury Bonds (T-bonds): Long-term securities that mature in 10 to 30 years. They also pay interest every six months.

Why Invest in T-bills

Safety: T-bills are considered one of the safest investments because they are backed by the full faith and credit of the U.S. government. The risk of default is virtually non-existent.

Liquidity: T-bills are highly liquid, meaning they can be quickly sold in the market without significant price changes. This makes them an excellent choice for investors who might need to convert their investments into cash on short notice.

Predictability of Returns: T-bills are sold at a discount to their face value, and investors receive the face value at maturity. The difference between the purchase price and the face value is the interest earned, making it easy to calculate and predict returns.

Flexibility in Investment Duration: T-bills offer a range of maturities (from a few days to one year), allowing investors to choose the duration that best fits their cash flow needs and investment strategy.

How to Buy T-bills

TreasuryDirect: This is the U.S. Treasury’s online platform for buying and managing Treasury securities. Investors must have a valid Social Security number (or taxpayer identification number) and a U.S. address.

Secondary Market: You may also buy Treasuries in the secondary market via brokers. Many brokerages give their customers full access to the bond market, but fees vary. Prices in the secondary market can fluctuate based on interest rates and other economic factors.

Buying Treasuries as ETFs via brokerage: It is possible to buy Treasuries through ETFs at most brokerages. ETFs are bought and sold like stocks, and many qualify for commission-free trades.

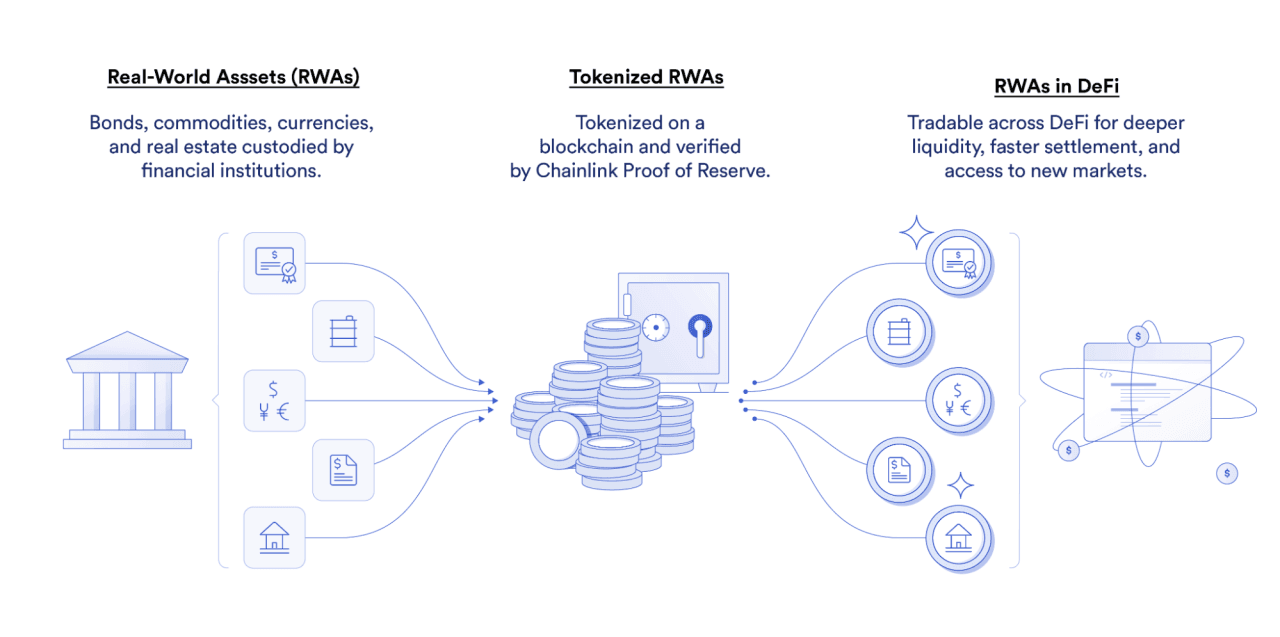

Buying JSHV token via Jarsy: we offers a product called JSHV token which is backed by iShares Short Treasury Bond ETF, accessible to global investors from not sanctioned countries, who have an account with us, start as low as $10 for the investment requirement.

Why Invest in SHV ETF via Jarsy

Investing in the iShares Short Treasury Bond ETF (SHV) via Jarsy presents a accessible and efficient option for both domestic and international investors. Here’s why choosing Jarsy to invest in the SHV ETF:

Global Accessibility: Jarsy's platform makes it easier for foreign investors to access U.S. treasury securities. With Jarsy, international investors, for U.S. and non-U.S. investors, can invest in the JSHV, which is backed by the SHV ETF, without needing to open a U.S. brokerage account, or having a U.S. social security directly.

Low Minimum Investment: Jarsy allows investors to start investing in the JSHV with as little as $10. This low barrier to entry makes it feasible for a wider range of investors to gain exposure to U.S. Treasury securities.

Ease of Use: Jarsy provides a user-friendly online platform that simplifies the process of purchasing, holding, and selling ETFs by buying and selling JSHV tokens.

Lower Transaction Costs: Typically, buying ETFs through a platform like Jarsy can result in lower transaction costs compared to purchasing individual treasury securities or using more traditional investment brokerages. This cost efficiency is crucial for maximizing investment returns.

Conclusion

Jarsy’s offering of the JSHV token, backed by the iShares Short Treasury Bond ETF, provides a solution for investors seeking to incorporate safe, stable, and liquid U.S. Treasury securities into their investment portfolios. Follow us on Twitter/X to see the latest updates of our offerings.

Recommended articles