Yiying Hu

2024年7月23日

This article explores how Marcus by Goldman Sachs, Betterment, and Jarsy are revolutionizing the financial industry by democratizing investing. Discover how these platforms make sophisticated financial opportunities accessible to everyday investors, leading the 2024 trend in inclusive and attainable investing.

In recent years, the financial industry has experienced a significant shift, driven by the increasing demand from younger generations. This transformation has been led by traditional financial giants like Goldman Sachs and innovative fintech startups like Betterment and Jarsy. These entities aim to democratize investing and make sophisticated financial strategies accessible to all.

Marcus by Goldman Sachs : From Wall Street to Retail Portfolio Management

Goldman Sachs, historically synonymous with elite investment banking, previously targeted customers with more than $10 million in assets for its wealth management services.

Recognizing the changing landscape, Goldman launched Marcus, a consumer banking platform designed for mainstream investors with an account minimum of $1,000. Marcus offers everyday investors high-yield savings accounts and personal loans.

More recently, Goldman provides investment options such as smart beta and ESG (source), all with a $0 banking fee. It's worth noting that Marcus Invest doesn’t allow users to buy and sell individual stocks, such as GameStop Corp. and other popular stocks that went viral on Reddit’s WallStreetBets message board. Goldman believes the best way to create wealth over time for most consumers is through diversified portfolios. Unlike Robinhood, Goldman didn’t design the app to drive user engagement through frequent trading (source).

Betterment: Pioneer in Robo-Advisory Services as Low as $10 to Start Investment

Betterment automates investment decisions based on user preferences and risk tolerance, thereby eliminating the need for costly financial advisors. With no minimum deposit requirement to open an account and just a $10 minimum deposit to start investing, Betterment has lowered the barrier to entry for many aspiring investors.

Betterment uses a range of low-cost ETFs that mirror established indexes to help build diversified investment portfolios. The exact mixture of funds depends on your profile and goals. For example, an emergency fund portfolio might hold roughly 15% stocks and 85% bonds, while a general investing fund for a 35-year-old investor—money not needed for a long time—might hold 90% stocks.

Betterment has successfully made sophisticated investment strategies available to a broader audience. The digital investing accounts of Marcus are expected to transition to Betterment, further lowering the threshold and offering advanced investment strategies once reserved for wealthy clients to customers of robo-advisers (source).

Jarsy: Democratized Investing via Self-Direct Investing in U.S. Equity and Pre-IPO Deals

Similar to the visions of Goldman and Betterment, Jarsy offers a unique opportunity for investors to start with as little as $10 and gain access to valuable pre-IPO deals and public equity. This approach mirrors the consumer-centric strategies of Marcus and the automated, no-hidden-fee, user-friendly experience of Betterment.

However, unlike these robo-advisers, Jarsy aims to serve an audience that wants to manage their money using their own investment philosophy. Unlike platforms where you buy a pre-designed investment strategy or portfolio, Jarsy allows for self-direction, enabling users to choose their investment direction, similar to Robinhood but with a much broader investment scope.

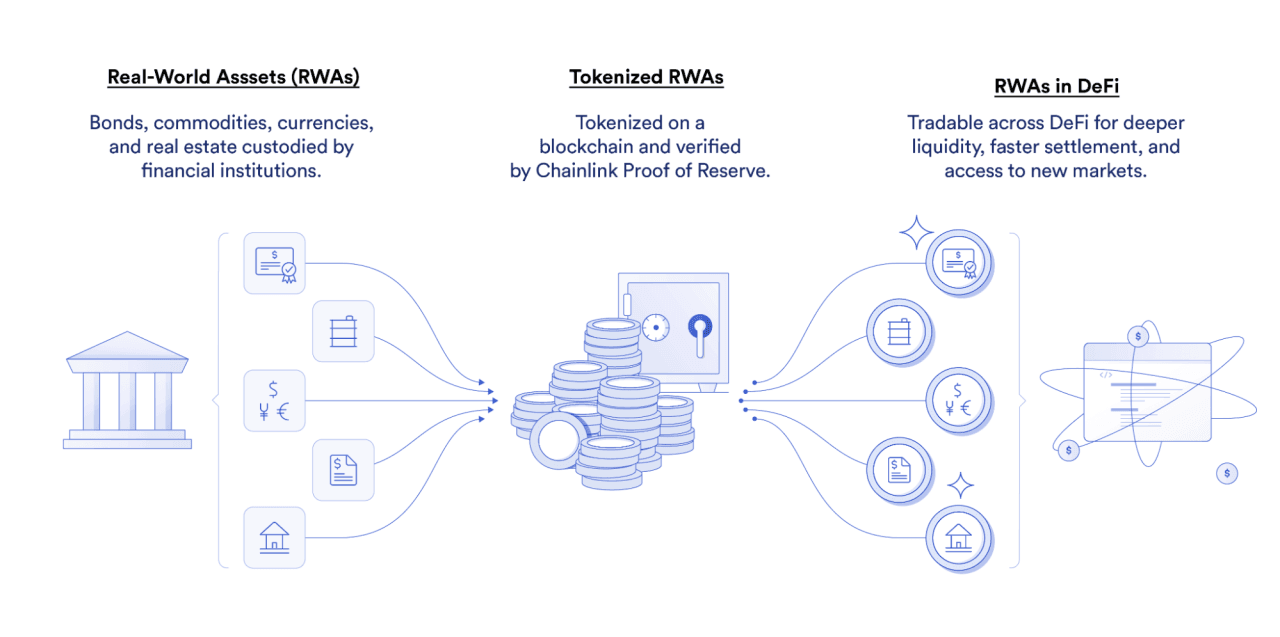

At Jarsy, we believe that sophisticated investment opportunities should not be limited to the wealthy. Our platform offers a wide variety of vertical options, allowing users to build and design their portfolios all in one place, transparently and cost-efficiently. By fractionalizing pre-IPO investments and public equity, we make it possible for anyone to own a piece of high-potential assets traditionally reserved for institutional investors.

Conclusion

The financial industry is undergoing a transformation, driven by the demand for more accessible and inclusive investment opportunities. Goldman Sachs’ shift to consumer-centric finance with Marcus, combined with Betterment’s innovative robo-advisory services, has paved the way for a new era of democratized investing. Jarsy is proud to be part of this movement, offering a platform that empowers everyone to invest in their future, regardless of their starting capital.

Recommended articles